The future of the global economy is uncertain. With the world’s largest economies in decline, and a lack of trust in traditional institutions, there is a need for new investment vehicles that offer greater return on investment than traditional stocks and bonds.

Findependent Review 2024 – Pros & Cons is a review of the diversyfund. It discusses the pros and cons of this investment.

In Switzerland, it does not seem that there will be a scarcity of Robo-Advisors anytime soon. In recent years, there have been an increasing number of new Robo-Advisors accessible to Swiss investors.

Findependent is a new Robo-Advisor on the market. They just began in the year 2024. However, they already possess some intriguing features. This review will go over all there is to know about Findependent, including its benefits and drawbacks.

Findependent is only accessible in German, so keep that in mind.

Findependent

Logo for Findependent

Logo for Findependent

Findependent began providing services in 2024. As a result, they are a relatively new addition to the Robo-advisors. They are a Swiss Robo-advisor created by Matthias Bryner, a former Neon employee.

Findependent’s mission is to make a simple service accessible to a large number of individuals who want to invest their money in the stock market for the long term. They seek a straightforward digital solution, similar to Neon’s banking system.

Furthermore, they aim to offer a low-cost service, therefore the prices are reasonable.

Despite being relatively young, they have already garnered over 600 clients as of September 2024 and are seeing rapid growth. In the following four years, they aim to make a profit.

You’ll need at least 500 CHF to establish an account with Findependent. 500 CHF is a great starting point, and it’s the lowest among Swiss Robo-Advisors. Your account will be cheaper if it is less than 2000 CHF (details later on).

Findependent only accepts Swiss citizens who are at least 18 years old. Furthermore, they are solely responsible for taxes in Switzerland.

Findependent is only accessible in German, as stated in the introduction, which may make it difficult for many individuals to utilize.

Investing Methodology

Findependent uses index ETFs in each of their portfolios, which is a very common investment approach.

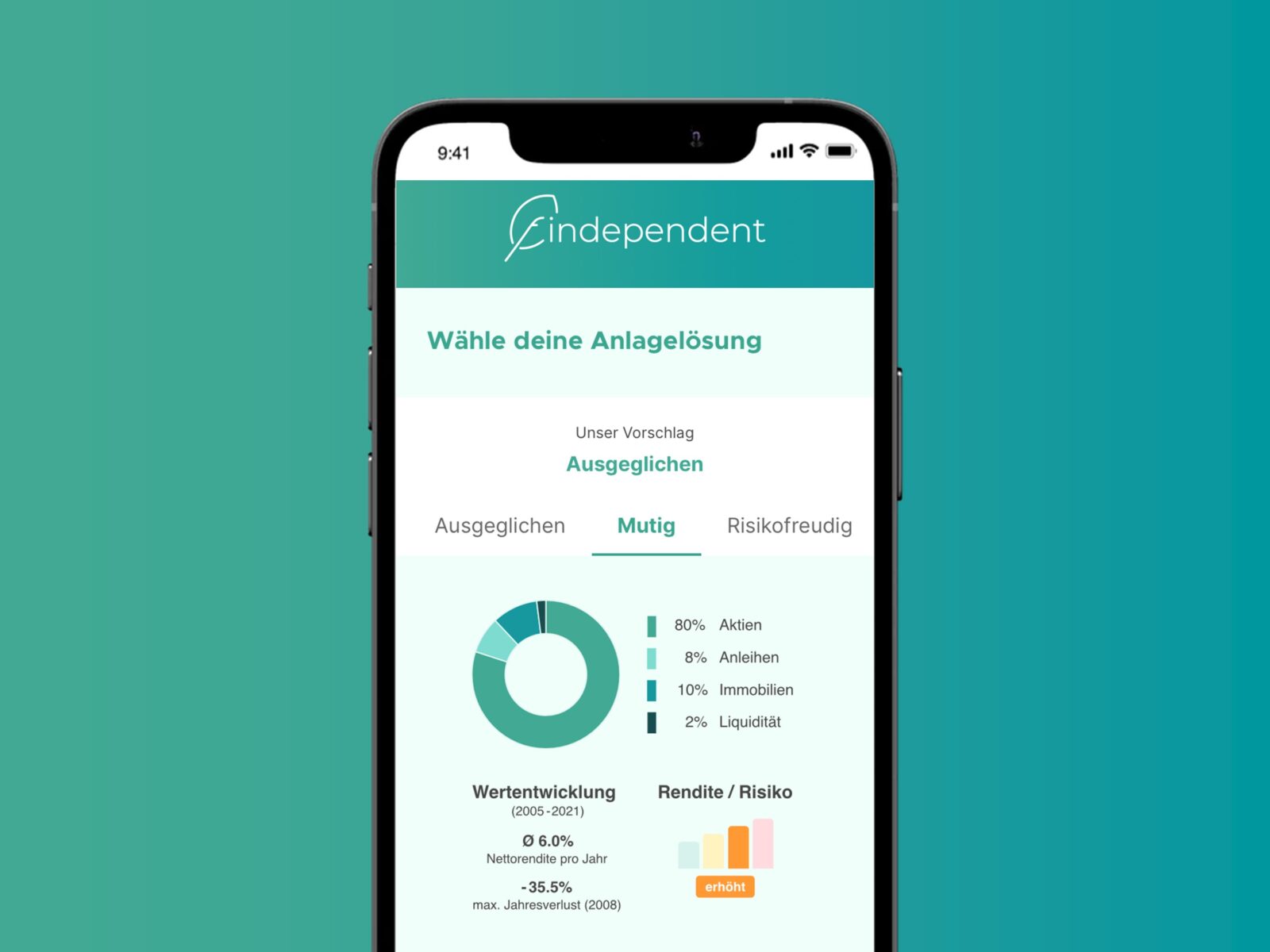

Their clients may choose from four distinct strategies:

- Be cautious: 40% of your portfolio should be in stocks, 48% in bonds, 10% in real estate, and 2% in cash.

- 60 percent invested in equities, 28 percent in bonds, 10% in real estate, and 2% in cash

- 80 percent in equities, 8% in bonds, 10% in real estate, and 2% in cash

- Risk-taker: 98 percent invested in equities, 2% in cash

These are sound tactics. It would be somewhat better if we could select the bond and real estate allocations. For example, rather having an 80/8 plus some real estate portfolio, I would like a true 80/20 portfolio. However, I do not think this will have a major impact. Also, the 98 percent stock portfolio does not include any real estate, which is fantastic.

In an ideal world, we’d be able to reach 99 percent equity ownership. We’d like 100 percent equities, but no Robo-advisor presently permits this since they require money to pay their fees. However, 98 percent in stocks is already quite good.

When you create an account, they will ask you the standard questions in order to determine your risk tolerance. They will recommend one of the four portfolios based on this information. If you disagree with their suggestions, though, you have the option to select for yourself.

Findependent is only utilizing 9 Exchange Traded Funds in these portfolios (ETFs). It’s fantastic that all of the ETFs they’re utilizing are physically replicating ETFs. Findependent is also extremely open, disclosing the specific ETFs they use in each of their portfolios.

Consider the following composition of the 98 percent stock portfolio:

- iShares Core SPI is at 29.4 percent (TER 0.10 percent )

- UBS SPI Mid 9.8 percent (TER 0.25 percent )

- iShares MSCI USA ESG is worth 30.4 percent (TER 0.07 percent )

- iShares MSCI Europe ESG, 12.7 percent (TER 0.12 percent )

- iShares MSCI Japan ESG, 4.9 percent (TER 0.15 percent )

- iShares MSCI Emerging Markets ESG (iShares MSCI Emerging Markets ESG) (iShares MSCI Emerging Markets ESG (TER 0.18 percent )

This portfolio is very strong, despite the fact that it might be simpler. The allocations make sense, and they’re made using low-cost ETFs. This portfolio’s total return on investment (TER) is about 0.12%, which is quite acceptable.

You may have noticed, however, that they compel you to invest in ESG ETFs. Environmental, Social, and Governance (ESG) is an acronym that stands for Environmental, Social, and Governance. One of the ways to invest sustainably is via an ESG ETF. They are not at all terrible ETFs. Findependent is excellent if you want to invest sustainably.

Findependent, on the other hand, should offer its customers the option of investing in ESG ETFs or not. These ETFs have a bias against certain businesses, and we don’t know whether this will help them perform better. Furthermore, these ETFs are more costly than non-ESG ETFs. So, in my opinion, a Robo-Advisor should let consumers to select whether or not to utilize them.

Of course, this is not a negative if you intend to invest long-term. Findependent is not for you if you want to have a choice.

Furthermore, with almost 40% of the portfolio invested in Swiss stocks, this portfolio has a significant Swiss tilt. Most individuals, in my opinion, have too much home bias, and I wish we could adjust that.

If you have less than 2000 CHF in your account, you will only be able to access 5 ETFs. In such scenario, your portfolio will be devoid of developing markets, Japanese businesses, and medium-cap Swiss companies.

Once a week, Findependent performs stock operations. As a result, your money will be invested once a week and, if necessary, rebalanced once a week.

Withdrawals and deposits

You’ll need to fund your account before you can begin investing.

To get started, you’ll need 500 CHF in your account, as previously stated. You’ll only have access to a selection of ETFs below 2000 CHF, but you’ll pay reduced fees.

Currently, like with other Robo-advisors, you may only deposit money in CHF. For security reasons, you must deposit funds from an account in your name.

The concept is the same for withdrawals: you may withdraw money at any time, but only to an account in your name. Because operations take place once a week, you may have to wait a week to get your funds.

Fees

Every review I write emphasizes the importance of investment fees. Fees must be kept to a minimum if you are a long-term investment. This is particularly true if you’re a passive index investor, since fees are the most effective way to boost your long-term gains.

With that stated, let’s look into Findependent’s fees.

Findependent levies a quarterly fee of 0.44 percent on your investments. So, if you have ten thousand Swiss francs with them, you will pay 44 Swiss francs each year.

Aside from that, there are a few expenses that aren’t included:

- The ETFs have annual fees ranging from 0.12% to 0.23 percent.

- A 0.50 percent foreign currency exchange fee is charged for each conversion.

- For each transaction, the stock market charges approximately 0.015 percent.

- Stamp duties on foreign securities are 0.15 percent, while stamp taxes on Swiss securities are 0.075 percent.

Based on your assets, this will result in a 0.56 percent charge each year for the most aggressive portfolio. Then there are the additional fees, which vary depending on how much you invest. This is a fantastic starting price.

These fees may rapidly pile up depending on how much you invest. They will add up to approximately 0.38 percent on each investment (and withdrawal) in the aggressive portfolio. These are not insignificant expenses, but in the long run, management fees are much more essential than one-time costs. When it comes to rebalancing, there will be some expenses.

It’s worth noting that the 0.44 percent charge will be waived for transactions under 2000 CHF. This no-cost investing option may be a fantastic way to get a feel for Findependent without having to pay hefty fees.

Is it secure?

If you wish to invest money online, you must first ensure that it is secure.

Findependent is well controlled in Switzerland, according to the laws. They’re also members of the Financial Services Standards Association (VQF) and the Industry Organization for Independent Asset Managers (BOVV). These are key regulatory bodies that guarantee that financial advisers are handling your money properly.

Findependent is putting your money and shares in the same bank as Neon, Hypothekarbank Lenzburg (HBL). Your liquidity will be insured up to 100’000 CHF with deposit protection. And your stock is registered in your name. You should be able to reclaim your shares if either Findependent or HBL goes bankrupt.

Findependent does not provide much information about technological security on their website, which is bad. I wish they would speak out more about it. For example, they should specify whether or not they provide a second factor of authentication.

However, one of the best features of their security is that you may only deposit money into an account that is in your name, which increases security.

Overall, Findependent seems to be as safe as other Swiss Robo-advisors. I simply wish they provided a bit more technical security information on their website.

Pros who are financially self-sufficient

Let’s have a look at the benefits of Findependent:

- Fees for good management and custody;

- Their fees are quite open and clear;

- It is possible to begin investing with as little as 500 CHF;

- Fees for management and custody are waived for amounts under 2000 CHF.

- Only be able to withdraw money from a bank account in your name;

- Regulations that are in place;

Cons of Financial Dependence

Let’s take a look at the drawbacks of Findependent:

- A brand-new platform;

- Only in German is it accessible;

- There is no online app; only accessible on mobile.

- It is not feasible to select whether or not to invest in ESG ETFs;

- Strong preference towards Swiss stocks;

- There are no options for modification;

- A brand-new service;

- On their website, there is no information regarding technological security;

Conclusion

Findependent is a fascinating Robo-Advisor in general. They have a great investment plan and charge extremely reasonable fees. It’s also a fantastic way to get started since the minimum deposit is just 500 CHF (2000 CHF for access to all ETFs).

They lack customisation capabilities, forcing consumers to invest in ESG ETFs, which may not be suitable for everyone. So, if you’re looking for a long-term Robo-advisor, I’d suggest Findependent. In that scenario, they may be the most cost-effective way to invest in sustainable ETFs. Keep in mind that investing in sustainable ETFs isn’t the most environmentally friendly option.

It’s also worth noting that they’re only accessible in German, which is unfortunate.

As is customary, I will state that I do not invest in Robo-Advisors. Instead, I’m investing directly via a broker account, which is considerably less expensive and gives me a lot more flexibility. However, not everyone wants to devote the effort to investing personally, which is where Robo-advisors come in.

If you’re interested in exploring other options, I wrote an essay on Robo-Advisors in Switzerland.

So, how about you? What are your thoughts about Findependent?

Directly to your email, we’ll provide you our finest tactics and suggestions.

Get free personal financial advice that can help you achieve Financial Independence!

The author of thepoorswiss.com is Mr. The Poor Swiss. He recognized he was slipping into the lifestyle inflation trap in 2017. He made the decision to reduce his expenditures while increasing his income. This blog chronicles his journey and discoveries. In 2019, he plans to save more than half of his salary. He set a goal for himself to achieve financial independence. Here’s where you may send a message to Mr. The Poor Swiss.

The how does ellevest work is a question that has been asked by many investors. Ellevest is a new investment platform that offers an easy way to invest in the stock market and cryptocurrency markets.