Businesses greatly benefit from financial planning, and accounting firms play a vital role in guiding them through the intricate financial terrain. This detailed examination draws on insights from experts across industries to showcase how accounting firms can enrich their services and establish themselves as partners to small businesses.

The Contribution of Accounting Firms to Financial Planning for Small Businesses

With their knowledge of regulations, tax codes, and business operations, accounting firms are well-equipped to offer guidance on financial planning to small businesses. Whether it is assisting clients in managing cash flow complexities or providing advice on tax optimisation, accounting firms can provide tailored solutions that address the challenges encountered by businesses.

-

Emphasising the Importance of Advisory Services

An approach for accounting firms to create value is to expand their service offerings beyond accounting tasks to include business advisory services. Mainly mid-sized firms can capitalise on their relationships with clients and in-depth understanding of their businesses to offer strategic guidance on financial planning, pricing strategies, and staffing concerns. Small businesses can benefit from a variety of services, including assistance with succession planning advice on entity structure and crucial cash flow planning, which remains a key challenge for many small businesses.

-

Marketing Knowledge and Expertise

Marketing knowledge and expertise are essential for accounting firms to distinguish themselves. Being recognised as an advisor is key as businesses look for accountants who can provide insights beyond mere number crunching. This involves showcasing expertise through avenues like blogs and seminars as engaging directly with clients to understand their specific needs and challenges.

-

Implementing a Financial Plan

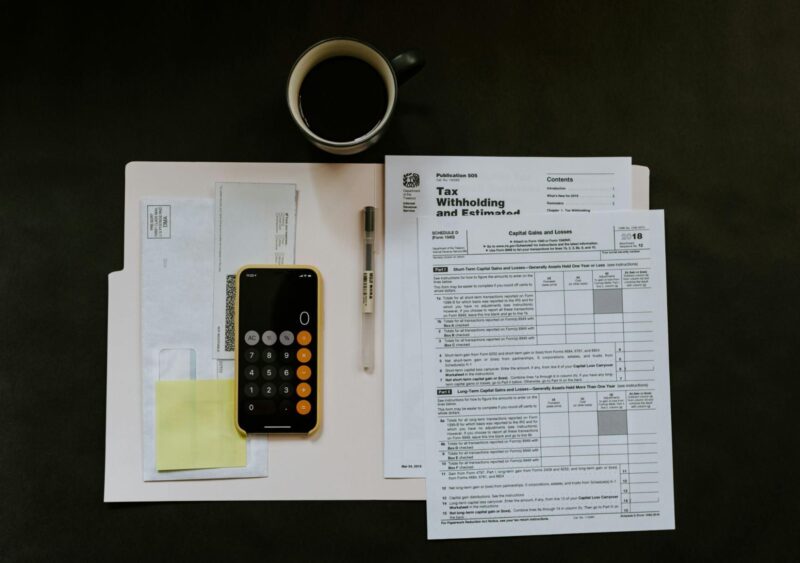

Creating a plan is vital for small businesses. Accounting firms can guide you through the process of creating financial statements such as income statements, balance sheets, and cash flow statements. These documents lay the groundwork for a financial plan that can help small businesses make informed decisions, allocate resources efficiently, and set the stage for future growth.

The Importance of Separating Personal and Business Finances

One critical piece of advice for small business owners is the separation of personal and business goals to ensure precise financial planning without compromising either side. Accounting firms can offer guidance on achieving this separation.

-

Leveraging Technology and Continuous Learning

Accounting firms must stay ahead of the curve by adopting the latest technologies and engaging in continuous learning. This includes utilising software for financial record management and staying informed about the latest tax laws and financial regulations. By investing in both people and technological tools, accounting firms can not only enhance their efficiency but also elevate the quality of service delivered to clients.

In summary, the contribution that accounting firms make to businesses through planning is substantial. By focusing on advisory services, effectively marketing their expertise, guiding clients through the financial planning process, and continuously updating their knowledge and tools, accounting firms can become indispensable partners to small businesses. This collaboration has the potential to foster improved well-being and expansion for enterprises, underscoring the vital role that accounting firms play within the broader business landscape.