Ally Bank CD rates are still up to 0.80% APY! This is the highest rate available for any CD in the United States.

Ally Bank has been an established bank for a long time. They offer special CD rates, which are still up to 0.80% APY!

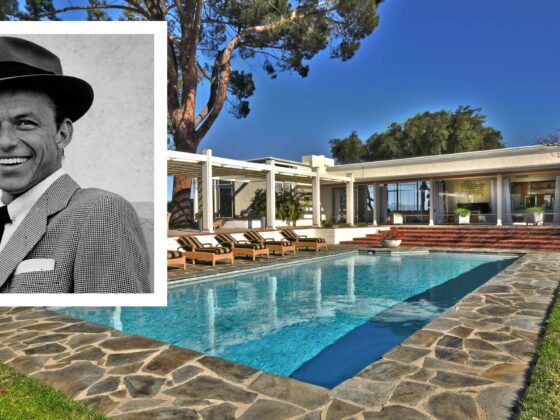

ally.com is the source of this picture.

[Update September 2024: Ally Bank’s CD rates have remained virtually constant over the summer and the first half of 2024. The only APY adjustment is on their three-month CD, which has been reduced from 0.20 percent to 0.15 percent. All of Ally Bank’s current CD rates are included lower down in this page.]

Ally Bank is a well-known digital bank that provides a variety of FDIC-insured online savings products such as CDs, savings accounts, interest checking accounts, and money market accounts.

[A review of Ally Bank’s money market account and its current APY can be found here.]

We’ll look at Ally Bank’s fixed-rate certificates of deposit in this study. They provide seven basic term CDs that range from three to five years in length and may be opened as regular CDs or IRA CDs. They also have two promotional CDs, one called “Raise Your Rate” and the other called “No Penalty.”

In a climate when interest rates are rising, the Raise Your Rate CD is advantageous. If their rate for your term and balance tier gets increased while your CD is active, you have the option to adjust your rate once over a 2-year term or twice over a 4-year term.

After the first six days of filling the account, the No Penalty CD enables you to withdraw any amount without penalty. There are no fines if you retain the interest you’ve earned.

For those who don’t know, Ally Bank is the rebrand of GMAC, General Motors’ banking arm. GMAC renamed as Ally Bank in 2009, after the financial crisis of 2008. Since then, they’ve won a slew of accolades for their online banking innovation, customer service, and dedication to giving back to their communities.

This article will teach you how to:

ally.com/bank/cd-rates/ picture credit

ally.com/bank/cd-rates/ picture credit

Ally Bank offers seven standard term certificates of deposit with no minimum starting deposit requirement, as previously stated. The periods vary from three to five years, with annual percentage yields that outperform the current national average by a significant margin and consistently rank among the best rates for online banks throughout the country.

Ally Bank CDs are guaranteed by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor or $500,000 for joint accounts.

CD Rates at Ally Bank

| Term | APY |

| 3 months | 0.15% |

| 6 months | 0.25% |

| 9 months | 0.30% |

| 12 months | 0.55% |

| 18 months | 0.60% |

| 3 years | 0.65% |

| 5 years | 0.80% |

According to the most recent FDIC statistics, the current national average for 12 month CDs and 5 year CDs is only 0.14 percent and 0.27 percent APY, respectively.

Ally offers a ten-day rate guarantee.

All CDs from Ally Bank are backed by a “ten-day best rate guarantee.” If you fill your account within 10 days of starting it and rates rise during that time, you will get Ally’s highest rate for that period and your balance tier at that time. This is also true with CD renewals.

Because interest is compounded daily, your total APY (annual percentage yield) is higher than with bank accounts that compound monthly or quarterly.

In more favorable savings rate settings, tiered rates by deposit amount exist; nevertheless, Ally Bank CDs pay the same APY for each term regardless of your current deposit amount.

Penalties for Early Withdrawal

Early withdrawal penalties at Ally Bank vary depending on the length of the CD. The following are the details:

- Early withdrawal penalties of 60 days’ interest apply to CDs having maturities of less than 24 months.

- Early withdrawal penalties of 90 days’ interest apply to CD periods of 25–36 months.

- Early withdrawal penalties of 120 days’ interest apply to CD periods of 37–48 months.

- Early withdrawal penalties of 150 days’ interest apply to CD periods of 48 months or more.

There is a grace period.

You have a 10-day grace period with Ally Bank to withdraw, add, or transfer money without incurring a charge. If nothing is done during this time, the CD will renew at the current APY with the same conditions.

CD Account Holders at Ally Bank Get Loyalty Rewards

For individuals that continue to establish and/or renew certificates of deposit with Ally Bank, they have a little-known reward program. When you renew any CD with them right now, you’ll get a 0.05 percent APY increase. Make sure to come back 30 days before your CD matures to see what the current reward is.

Ally Bank’s Raise Your Rate CD is best suited for an interest rate environment when rates are rising. Given that CD rates are usually set for the life of the CD, the ability to increase your CD rate while interest rates are rising may be a significant advantage. Many other banks do not provide this service.

Raise Your Rate CDs by Ally

| Term | APY |

| 2 year | 0.55% |

| 4 year | 0.55% |

Over the course of the two-year Raise Your Rate CD, you will have the option to raise your rate once.

Over the course of the four-year Raise Your Rate CD, you will have the option to raise your rate twice.

After 6 days of account financing, you may withdraw any amount without incurring any fees.

After 6 days of account financing, you may withdraw any amount without incurring any fees.

At the present, the Ally Bank No Penalty CD has just one term. The duration of the contract is 11 months. After six days of financing the account, you may withdraw some or all of your money from this deposit.

CD Rates at Ally Bank with No Penalty

The APY is the same regardless of the amount you deposit, as it is with Ally Bank’s other certificate of deposit products. In the past, Ally Bank offered greater returns for bigger deposits; however, today’s rates remain the same for all sums.

With no monthly maintenance costs, no starting deposit restrictions, and even the option to create a “no penalty CD” with fee-free access to your deposited money, Ally Bank makes CDs easy and profitable.

The APYs on their IRA CDs and ordinary CDs outperform the current national average(s) by a wide margin, yet all terms pay the same returns regardless of deposit size. There are no rate variations between CDs opened in an IRA and CDs not opened in an IRA.

The digital interfaces of Ally Bank – both online and via their IOS and Android applications – are extremely user-friendly and allow for quick deposits and account monitoring.

The cit bank cd rates is the current interest rate offered by Citibank. It’s still up to 0.80% APY!

Frequently Asked Questions

What is Ally current APY?

Allys current APY is 0.01%

Will CD interest rates go up in 2024?

Are ally CD rates fixed?

No, ally CD rates are not fixed.

Related Tags

- highest cd rates

- ally bank savings rate

- synchrony bank cd rates

- capital one cd rates

- ally bank rates

ally.com is the source of this picture.

ally.com is the source of this picture.