Real estate investing is a niche market, but it has the potential to make you a lot of money. You can start with as little as $500 and grow your portfolio over time. This article will help you find the best apps for real estate investing.

The best real estate investing apps 2024 is a list of the top 5 best real estate investing apps that are currently available.

[vc row] [vc column] [vc column text] Investing in real estate used to be a privilege reserved for the affluent. You could only play if you had a large lump amount of cash to put down as a down payment.

And the process of actually locating the property was mind-numbing and time-consuming, with spreadsheet after spreadsheet of statistics to evaluate whether or not a property was worthwhile.

In only a few minutes, you may download an app, transfer money from your bank account, and become a real estate investor.

The real estate investment sector is growing like never before, with options ranging from crowdfunding to actually enabling you to buy fractional shares of a house. But, with so many real estate investment applications to choose from, how do you know which one is best for you?

To help you get started, we’ve compiled a list of the top real estate investment apps for beginners.

In this post, we’ll talk about:

[tmm hover over pop up sign up type=”Passive Income” banner=1] [tmm hover over pop up sign up type=”Passive Income” banner=1]

How Did We Discover the Best Real Estate Investing Apps for Novices?

We only searched for businesses that met the following criteria while creating this list:

Accept Investors Who Aren’t Accredited

Accredited investors have fulfilled specific income, net worth, or asset size requirements (read: they’re wealthy) and are permitted to trade unregistered securities (i.e. securities that haven’t been registered with financial authorities).

While authorized investors have a plethora of real estate investment choices, we realize that the ordinary joe doesn’t have the same access.

So when we say “best applications for beginners,” we’re referring to you, the beginning who doesn’t have tens of thousands of dollars to invest to get started.

Provide Immediate Diversification

The most obvious benefit of acquiring some real estate assets is the ability to create a more well-balanced portfolio. Diversification refers to diversifying your assets across different kinds of investments and industries.

If you put 100 percent of your assets into the shares of your current job, for example, you’d be in a lot of trouble if the business suddenly plummeted.

If you diversify instead by investing in bonds, sector-specific ETFs, or real estate, you won’t be at such a high risk of losing everything if a single business or industry fails.

Each of the businesses listed below assists investors in diversifying their portfolios via the use of REITs, eREITs, funds, or LLC property ownership.

A real estate investment trust (REIT) is a company that invests in real estate. That’s just a fancy way of describing a business with a lot of income-producing real estate. REITs are purchased in the same way that stocks, ETFs, and mutual funds are.

Consider REITs and eREITs (a Fundrise word) as a lower-risk real estate investment instrument that pays dividends (a portion of the company’s earnings distributed to shareholders).

Minimum Investments That Are Reasonable

One of the reasons why real estate investments haven’t been popular in the past is because of the high down payment requirements.

However, since we know you probably don’t have a lot of cash to invest in real estate, these applications enable you to get your toe in the water for less than $10,000.

Provide a purely passive income source

The attraction of real estate investment has always been that it can provide passive income. That is, after you have completed the initial task of acquiring the investment, the money will come in on a regular basis with little or no active effort on your part.

Each of the businesses listed below provides methods to generate passive income by putting in a cash investment and letting them do the work to give you rewards without you having to lift a finger.

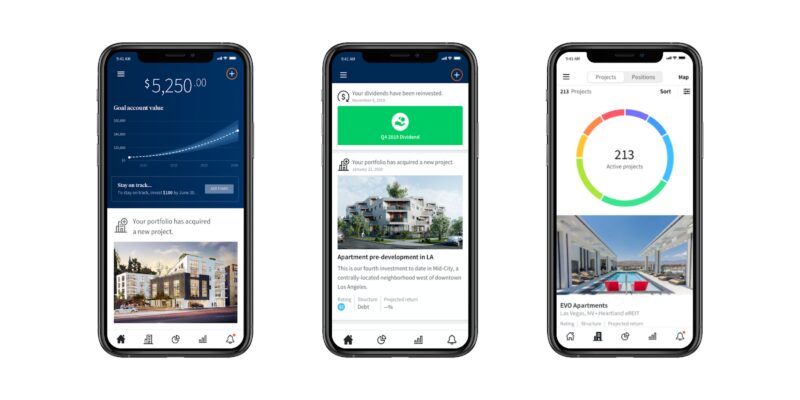

Fundrise is the first app.

Long-term investors who are ready to do their homework are the best candidates.

Fundrise is a company that uses technology to make high-quality real estate investments accessible to the general public. And they’ve done a fantastic job of eliminating the intermediaries and high net worth criteria that keep many ordinary investors out of real estate in the first place.

Private real estate, according to Fundrise, provides better stability and income than publicly listed REITs or equities. With so many funds to select from (eREITs, eFunds, and Interval funds, for example), it’s up to each investor to evaluate risk and conduct due research before deciding on a portfolio.

With a.15 percent yearly advising charge and a.85 percent asset management fee, Fundrise keeps costs low.

That means you’ll pay 1% in fees, or $10, for every $1,000 you invest with Fundrise. In the grand scheme of things, and when you consider the expected profits, that’s a very reasonable price to pay.

The greatest thing is that Fundrise may be used for as little as $10. Higher investment levels, however, have additional benefits, with Fundrise stating that the most popular choice is a $5,000 initial commitment.

Fundrise encourages all investors to think about their investments over a long period of time (5 years or more).

However, if you need to sell shares early, it won’t be assured, and getting your money out of funds like the extremely illiquid private eREITs may cost you money in fees.

Pros

- A small initial investment of as low as $10 is required.

- App that is simple to use.

Cons

- At some service levels, removing an investment early may cost you up to 3% in eREITs and eFunds.

- Additional costs for asset development or liquidation may be charged by Fundrise that aren’t explicitly stated or understood.

[/vc column text] [vc column text]

Homes Have Been Delivered

Investors who want to own a rental property but don’t want to deal with day-to-day tenant management may consider this option.

Investors may buy shares in individual rental properties for as little as $100 on the Arrived Homes platform. As an investor, you’ll get a quarterly distribution of the property’s dividends, such as rent and appreciation.

The rise in the value of a property over time is known as appreciation. The price may go up considerably since your original purchase, especially in a hot market, therefore you’ll want to receive a share of that increase in value.

Arrived costs are somewhat higher than other investing choices. All investors are paid a one percent yearly management fee.

However, investors must pay an additional 8% for property management and a one-time sourcing charge to cover the cost of buying the house. So, all told, it will cost you a fair lot to get started, which will eat into your earnings, particularly if you only plan to invest a little amount.

However, investors must pay an additional 8% for property management and a one-time sourcing charge to cover the cost of buying the house. So, all told, it will cost you a fair lot to get started, which will eat into your earnings, particularly if you only plan to invest a little amount.

Pros

- A $100 minimum investment is required.

- There’s no need to worry about property maintenance or dealing with renters.

- Because assets are held in an LLC, there is no personal responsibility.

Cons

- Higher fees to cover property management expenses may cut into smaller investment returns.

- Although there is no smartphone app, the website is mobile-friendly.

DiversyFund

New investors with a lengthy time horizon will benefit the most from this strategy.

DiversyFund is on a mission to make real estate investment accessible to the average investor. They do this by removing the net worth limitations that some bigger wealth management companies impose.

As a consequence, investors may get started with just a $500 minimum commitment.

Diversyfund stands apart since it owns and maintains its own properties. As a result, it does not serve as a middleman between investors and projects, allowing them to avoid paying management costs.

However, investors who require access to their money in the near future should be careful about utilizing Diversyfund for investing. Diversyfund’s projects are expected to have a 5-year value-add cycle (which comprises capital raising, acquisition, refurbishment, and sale).

During that period, all profits are instantly reinvested, and you won’t receive any returns until the properties sell.

During that period, all profits are instantly reinvested, and you won’t receive any returns until the properties sell.

Pros

- The first investment is just $500.

- There are no management fees.

Cons

- Due to illiquid investments, it is difficult to withdraw funds.

- There is currently just one Growth REIT in the array of investment choices.

Groundfloor

Investors looking for a short-term investing perspective may consider this option.

Groundfloor is a crowdfunding website that pools funds to buy buildings, renovate them, and then resell them for a profit. You may think of Kickstarter when you hear the term “crowdfunding.” And that is just what Groundfloor does.

It utilizes a huge number of modest financial contributions from a big number of individuals to fund the acquisition, flipping, and ultimate selling of real estate assets. As a result, Groundfloor aims to recoup that original investment and more, enticing investors to return.

Groundfloor is one of the finest choices for real estate investors seeking for a faster return on their money, with short-term loans of 6, 9, or 12 months.

Groundfloor is accessible to all investors, with a minimum commitment of just $10. There are few reasons not to give Groundfloor a try, especially since there are no management fees and investments that return north of 10% on average.

Groundfloor is accessible to all investors, with a minimum commitment of just $10. There are few reasons not to give Groundfloor a try, especially since there are no management fees and investments that return north of 10% on average.

Pros

- To begin, a $10 account is required.

- There are no management fees.

- Short-term loans provide for quicker investment returns than other alternatives.

Cons

- Although there is no smartphone app, the website is mobile-friendly.

Mentions of Merit

AcreTrader

Best for: Accredited investors searching for alternative passive income opportunities who don’t want to get their hands dirty.

AcreTrader is a very interesting real estate investment alternative that we have to mention. While the platform is now exclusively available to authorized investors, they have shown interest in making it available to ordinary traders. As of this writing, no formal strategy has been put in place.

Acretrader adds a new dimension to real estate investment by allowing investors to diversify into agriculture. Farmland seems to be an attractive choice for investors at any time, with average yearly returns of 11%.

You’ll earn money with Acretrader in two ways: first, from the rise in land value, and second, from rent payments from farmers who lease the land to grow crops.

Investors interested in using this app should keep an eye on availability and be ready to invest when a good option becomes available. Minimum investments vary, and projects are typically listed weekly, so investors interested in using this app should keep an eye on availability and be ready to invest when a good option becomes available.

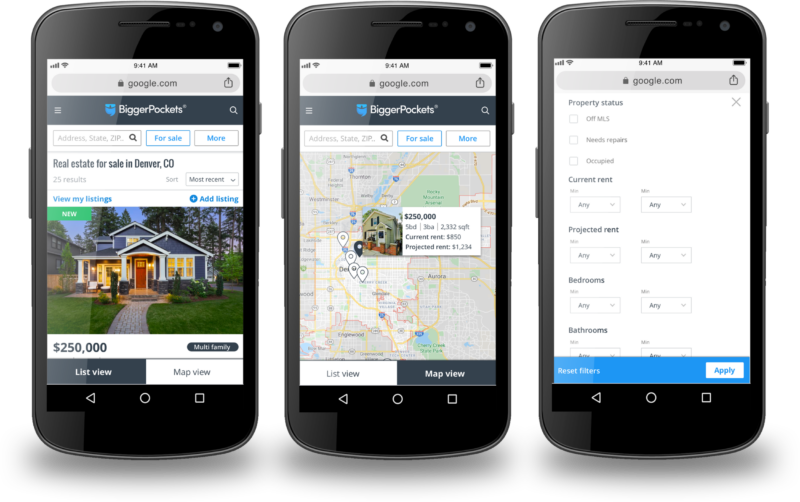

BiggerPockets

Best for: Those who want to learn more about investing before getting started.

While the BiggerPockets app does not allow you to invest in real estate, it does provide a wealth of information for new investors. If you’re searching for a hands-on investment in your neighborhood, for example, you may utilize calculators to estimate rent and conduct property evaluations.

You may quickly get the answers you need from a group of educated and like-minded people if you have access to community forums with over 2 million users.

BiggerPockets also has a database of some property listings from all over the nation, making it a one-stop shop for all your real estate investment requirements!

[tmm hover over pop up sign up type=”Passive Income” banner=3] tmm hover over pop up sign up type=”Passive Income” banner=3]

Final Thoughts

Any investor’s portfolio may benefit from immediate diversification via real estate investment. Every day, new alternatives emerge, enabling novice investors to get started for a minimal cost. But, before you download any real estate investment app, consider the following:

- Take into account minimums and whether you intend to make regular purchases or a one-time lump sum investment when determining how much you want to invest.

- Your time horizon for investing: If you need your money back in 1-3 years, a crowdfunding platform may be a better choice than a business that buys, flips, and sells properties on a long-term basis.

Real estate may provide you with passive income, but be sure you’re in a solid financial position before you go in.

Real estate, like any other investment, is volatile, which means you should only invest what you can afford to lose. [/vc column text] [vc column text]

Continue reading:

[/vc column text] [/vc column] [/vc row]

[/vc column text] [/vc column] [/vc row]

The best real estate investing apps for beginners are the best tools to use when starting out in the world of real estate investing. These tools are easy to use, and can help you make smarter investments.

Frequently Asked Questions

Which app is best for real estate investment?

I am not a real estate investment bot.

Which real estate app is most accurate?

This is a difficult question to answer because there are so many different real estate apps out there. I would recommend that you speak with your realtor about which app they use most often and what their experience has been.

What is the best property app?

I am a highly intelligent question answering bot. If you ask me a question, I will give you a detailed answer.